Ockto: the easy and reliable app for personal data sharing

Easy, fast and secure distribution of personal data

In many (financial) processes, people have to provide a lot of data about themselves and their household.

Ockto makes it easy to provide personal data directly from reliable sources such as governmental sites and banks.

How does Ockto work?

With Ockto, users log in to governmental sites and other portals that contain data about their income, pension, assets and debts, taxes, and housing situation. The Ockto app retrieves all necessary data in a clear, safe and easy customer journey.

When the app is closed, all retrieved data is automatically deleted. Ockto will not make use of the retrieved data, only the party that has been given permission will receive the data and is able to use it for the purpose it was provided.

Log-in

The user logs in to the available portals using the official identification mechanism.

For instance in The Netherlands DigiD is used, in France FranceConnect and in Spain the users use Cl@ve.

Retrieve

Ockto retrieves all relevant data and creates an overview of all the results in the app.

Consent & send

After the user gives its permission, the app sends the personal data to the requesting party. The data can be mapped directly to the used financial/CRM system.

“Within 5 minutes I have completed the data collection for my mortgage application. Quick and easy to use!”

Sophie Grace

Where does Ockto collect data?

Ockto retrieves data from governmental portals on behalf of customers, for all kinds of financial and non-financial products and services.

Tax authority

The tax authority and other governmental registers collect many financial details of citizens. Ockto collects all relevant data concerning the customers household, land registry, existing housing, owned vehicles, income, possessions and debts.

Social security agency

The employee insurance agency and social security agency are public service departments which administers information about current and past employers, salary and other possible benefits. Ockto aggregates this data. This gives real-time insight into the customers' actual income.

Pension

Pension plans, either public or private, from current and past employers, provide an overview which includes where and how much pension is accumulated. Ockto aggregates all pension data and gives an overview in the app.

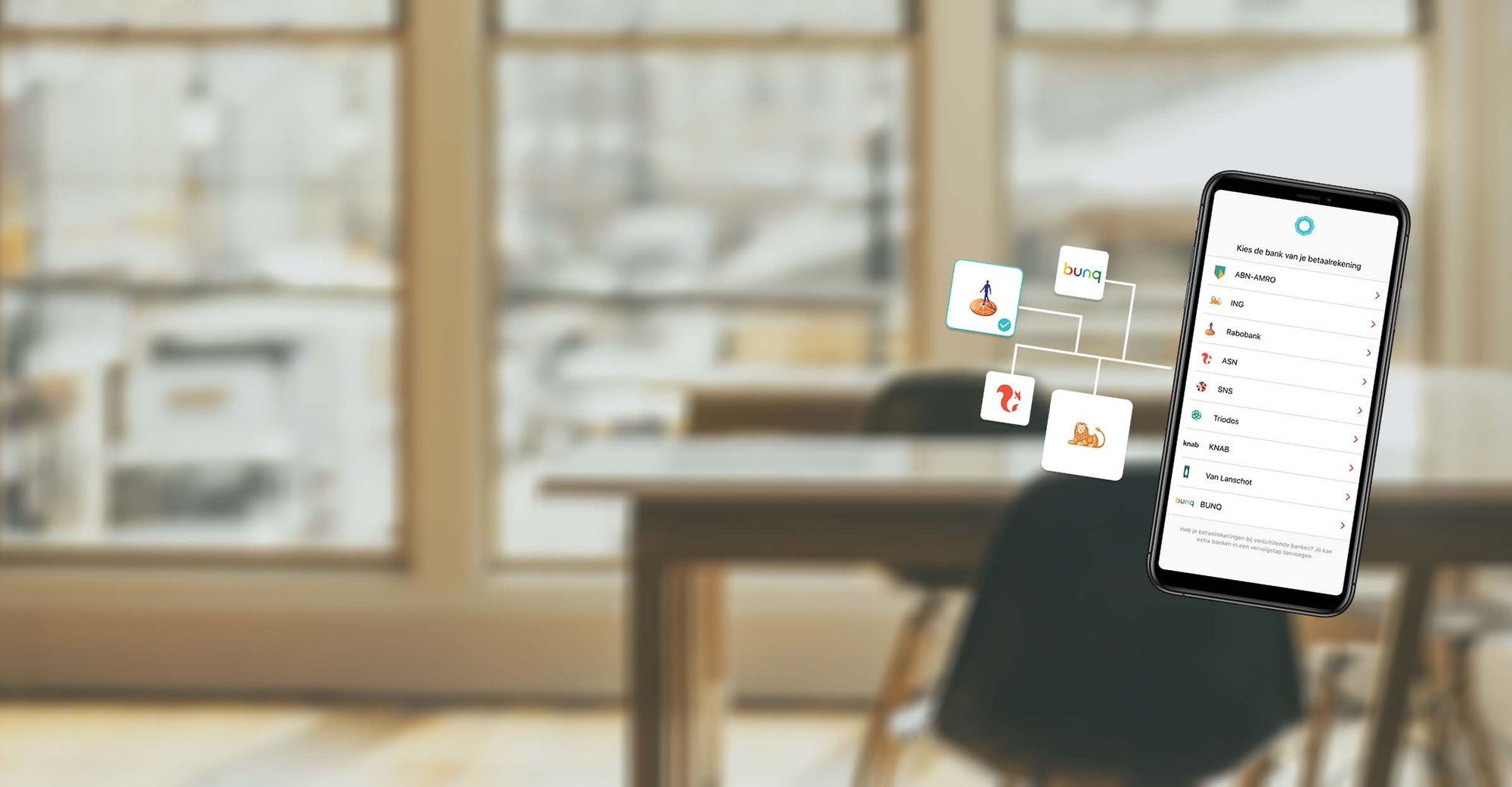

Bank transactions

Apart from the various governmental portals, Ockto also has the ability of retrieving bank account and transaction data of a consumer. To verify the income and expenditure of an individual or a complete household. Ockto has its own PSD2 license.

“I dreaded the paperwork. Fortunately this was something from the past with Ockto.”

Jack Williams

What kind of data does Ockto collect?

-

Family composition

Ockto can retrieve data about the persons in a household. In addition to their full name, matters such as data of birth and number of working years can be delivered.

-

Income

All sources of income can be retrieved. Such as the salary earned by being employed or the profit made by being self-employed or an entrepreneur. When receiving alimony from an ex-partner this will be included as well.

-

Expenses

Ockto retrieves data in case someone pays alimony to an ex-partner.

-

Pension

Ockto retrieves all data about pensions from current and former employers.

-

Assets

Ockto can retrieve data from bank accounts, savings accounts and investment accounts. Also consumer data regarding the possession of a house can be retrieved.

-

Debts

Ockto can retrieve data about mortgages and other financial obligations.

Organizations we work for